THANK YOU FOR SUBSCRIBING

RealVantage Launches the First of Its Kind Real Estate Co-Investment Platform

RealVantage launched its platform for acquisition management and optimization of offshore real estate portfolios for accredited investors.

By

Apac CIOOutlook | Friday, January 24, 2020

Stay ahead of the industry with exclusive feature stories on the top companies, expert insights and the latest news delivered straight to your inbox. Subscribe today.

RealVantage launched its platform for acquisition management and optimization of offshore real estate portfolios for accredited investors.

FREMONT, CA: Singapore's renowned real estate co-investment firm, RealVantage, launched its platform for acquisition management and optimization of offshore real estate portfolios for accredited investors.

The platform was launched along with a team of institutional investment experience, bringing opportunities for offshore ventures across various real estate classes and investment strategies for accredited investors.

With the launch of this co-investment platform, both the accredited investors and High Net Worth Individuals (HNWIs) will obtain access to a wide array of real estate options in various countries, sectors, and investment spectrums.

Investors will be presented with a plethora of options to choose from, such as a stable income-producing office in the UK or a multi-family asset re-positioning project in the USA or even a townhouse development project in Australia.

RealVantage was the brainchild of Keith Ong and Mao Ching Foo when they identified the synergies of bringing together real estate business review and technology with their complementary expertise. Being well-versed in real estate fund management, technology, and data science, the duo focused on leveraging the potential of technology to accumulate investors to access bigger deals, and deliver greater investment decision-making via data-driven insights.

RealVantage understands that the major share of the investors works with a short window, which is why the firm has hired well-qualified and experienced real-estate asset managers to increase the returns of investments by proactively managing the property investments. The team enriches the firm with cross-border investment track records exceeding the US $10 billion and has also managed assets that are listed more than the US $20 billion across different countries.

The RealVantage's in-house expert team screens close only 600 deals annually by handpicking the opportunities that suit their investment criteria by applying a proprietary AI engine to offset their deal origination and evaluation processes.

Industry veterans like Anthony Ang, CEO of Sasseur REIT, and the former CEO of Fortune REIT, and Richard Tan, an independent real estate advisor and former CFO of Suntec REIT, make up the internal investment committee that will subsequently vet the deals for approved. The approved contracts are aggregated into a memorandum that details the investment strategy, financial analysis, investment period, and deal terms. This document is uploaded onto the platform and availed for investors. Since a rigorous selection process is followed, only a small percentage of deals get through the investment committee.

Investors are kept in the loop, fully appraised of their investments via regular updates on the company's platform from the co-investment until divestment. The provision of institutional-quality deal underwriting shows full transparency and disclosure, increasing the credibility to the entire process.

RealVantage closed its funding round with angel investors recently, and the company now has its presence in Indonesia, since 30 percent of its investors hailing from the country; the other 70 percent of the investors are from Singapore.

In the next year, RealVantage plans to expand its investor base in Singapore and Indonesia. The platform is also keen to look at investment opportunities beyond the UK and Australian markets.

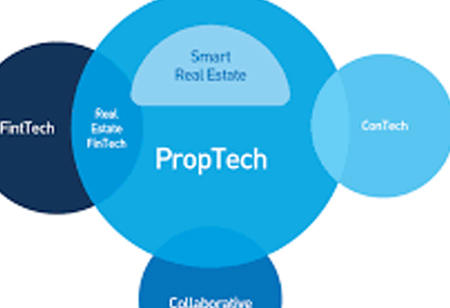

See Also: Top Proptech Solution Companies