THANK YOU FOR SUBSCRIBING

Transparency in Banking Transactions through Blockchain

The banking industry has seen huge innovations in recent years with the use of technology. To satisfy the demands of the customers, banks are looking for new ways to interact with them and provide better customer satisfaction.

By

Apac CIOOutlook | Wednesday, December 12, 2018

Stay ahead of the industry with exclusive feature stories on the top companies, expert insights and the latest news delivered straight to your inbox. Subscribe today.

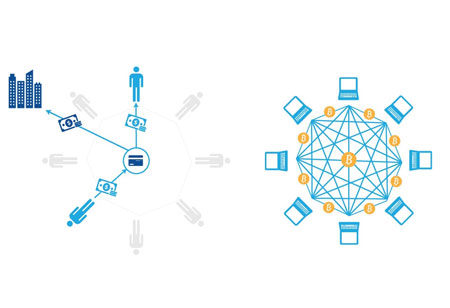

The banking industry has seen huge innovations in recent years with the use of technology. To satisfy the demands of the customers, banks are looking for new ways to interact with them and provide better customer satisfaction. Blockchain technology is changing the process of banking along with the concept of game theory to meet customer needs.

Baking as a Service (Baas) is an innovative concept that takes the customer experience to a new level. It has no any restrictions like traditional banking. In today’s era, customers are in need of anywhere anytime transactions, beyond the regular working hours of the banks. There is a need for open collaboration since customers are looking for a more open network and shared technologies. Collaboration and consolidation is the key to BaaS. This flexibility of the BaaS model will enable banks to integrate blockchain solutions to solve the issues in the banking sector.

The game theory in banking pays attention to the behavior of people in their transactions. Banking reaches suboptimal equilibrium state when there occur false transactions with less transparency causing systemic inefficiency. The banking sector currently works in the suboptimal equilibrium, as they are not aware of the transactions trust and transparency. Blockchain with game theory can build trust by recording the transactions on an open ledger.

BANKEX is a global financial technology company, which is developing a tokenization ecosystem providing its customers with technology and services at every stage. BANKEX uses a Proof-of-Asset (PoA) protocol to connect Bank-as -a-service (BaaS) and blockchain. The qualities of an asset are merged and verified digitally in the Proof-of-Asset protocol. Then the asset is made virtual as a token that can be bought and transferred. The aim of proof of asset protocol proposed by BANKEX is to avail continuous auditing of an asset to check its existence and minimize the risk of carrying out transactions.

Blockchain technology could have an enormous impact in enabling easier and secure transactions, optimizing assets, and managing cash. The banking sector is expected to reap several other benefits by implementing blockchain in their processes. The technology will increase efficiency, speed, security, and lower costs in all their operations. Blockchain will result in a vast improvement in the quality of their services to their customers.

Check Out This: Global Financial & Leasing Services.